The eighth annual edition of the Global Chinese Art Auction Market Report was released by Artnet on Nov 9. A joint project between Artnet and the China Association of Auctioneers (CAA), the report was first launched in 2013 to offer an accurate and detailed picture of China’s booming art auction market.

CAA, as China’s only association with government backing, has access to comprehensive data and Artnet, in turn, provides the analysis of the auction market’s ‘overall volume and size, sector trends, and key players.’

Analyzing China’s pre-pandemic market landscape, the report captures shifting domestic trends and situates them within a global context offering transparency for buyers, sellers, and collectors.

Here are Jing Culture & Commerce’s key takeaways from the report.

Global auction sales drop

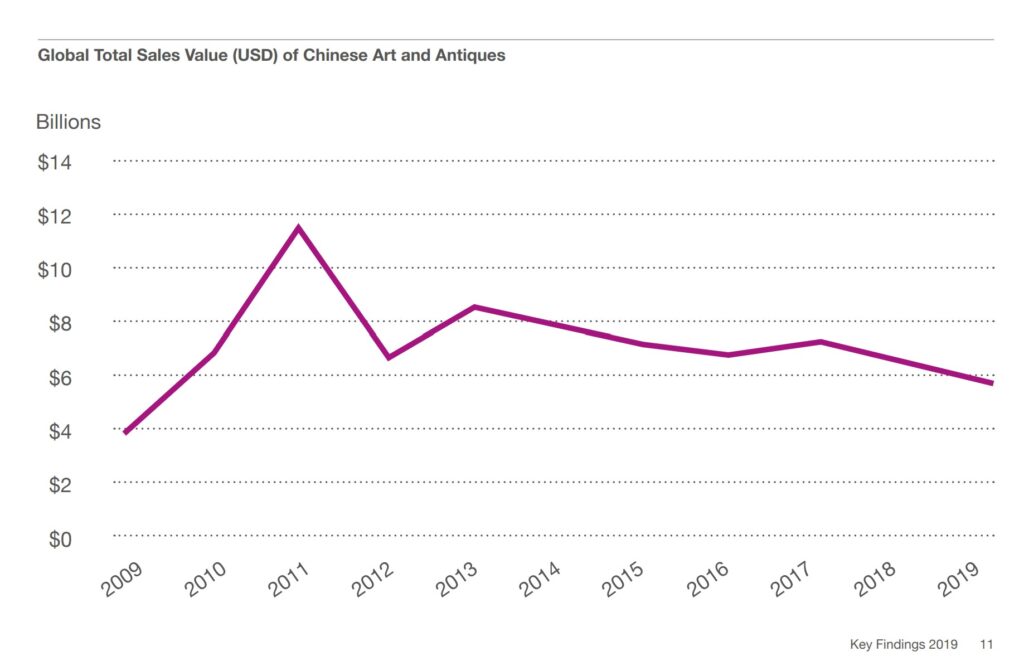

Total auction sales in China reached a 10-year low falling 10 percent to $3.7 billion in 2019. In global markets, there was a nine percent contraction in the sale of Chinese art and antiques compared to previous years. Global auction sales also decreased by 10 percent and totaled $5.7 billion in 2019.

The decline in sales was influenced by the continuation of trade tensions between the US and China and worsened by China’s economic slowdown. This was a global trend with the U.S. and the U.K. also seeing significant sales decreases.

Global sales continued to slide in 2019. Image: Global Chinese Art Auction Market Report.

What the report says: “The trends seen in mainland China mirrored global market behavior for fine art as a whole, as major art market hubs experienced contractions in 2019. Total sales for art in the United States and the United Kingdom, typically the strongest global markets along with mainland China, dropped by 15 percent and 16 percent, respectively, from 2018 to 2019.”

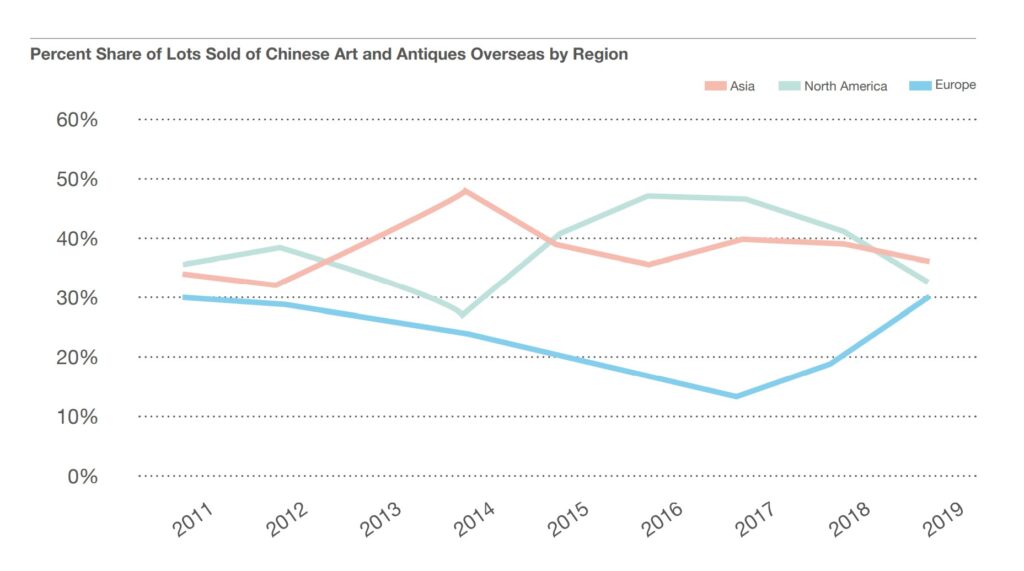

North America and Hong Kong market share falls

Europe’s total global share in the market rose to 29 percent as there was a significant rise in the lots offered and sold. North America, however, saw its market share drop from 41 percent to 32 percent.

In the wake of Hong Kong’s civil unrest, lots hit a seven year low with the market contracting $1.3 billion and sales dropping 10 percent.

The impact of COVID-19 is yet to be measured, but is expected to have significantly impacted the long-term future of China’s art and antiques market.

Geopolitical tensions and looming art-focused tariffs damaged U.S. and Chinese lots. Image: Global Chinese Art Auction Market Report.

What the report says: “Although market demand for Chinese art and antiques grew in 2018 in Asia, disruptions in the auction cycles due to the protests in Hong Kong contributed to a decline of 14 percent in lots offered year-over-year in the region, recording its lowest level since 2013 and an 11 percent drop in total sales value for the region.”

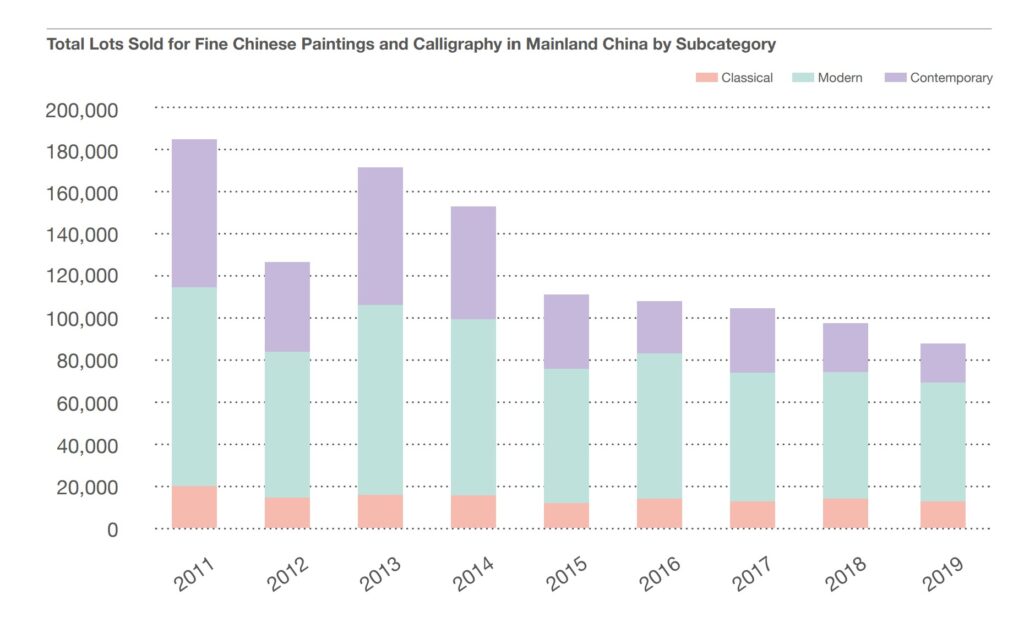

Contemporary Chinese art soars, fine Chinese paintings and calligraphy spirals

Fuelled by a younger generation of Chinese collectors, the sale of 20th Century and Contemporary Chinese Art increased by 23 percent — the only collecting category to see transaction volume and value growth.

In comparison, the largest collecting category, Fine Chinese Paintings and Calligraphy, reached its lowest point since 2014 with the number of lots sold in China dropping 10 percent.

Young Chinese collectors continue to show interest despite broader market uncertainty. Image: Global Chinese Art Auction Market Report.

What the report says: “Bolstered by the unwavering enthusiasm of a younger generation of Chinese collectors, 20th-Century and Contemporary Chinese art had a strong performance both on the mainland and overseas in 2019 […] As the largest collecting category in mainland China, Fine Chinese Paintings and Calligraphy continued to spiral downwards in total transactions by volume and by value.”

High end market declines by almost a third

The high end market — lots valued at $14.4 million and up — declined by 31 percent. This was due to a decrease in availability of high quality pieces and the current uncertainty within the economic climate. However, the Chinese art auction market situation remains optimistic as Artnet notes, “collectors are still willing to pay top dollar for top-flight lots.”

What the report says: “As collectors became more cautious under the uncertain economic climate, works that used to fetch high price points in previous years now face a harder test based on quality. For example, Qi Baishi’s scroll, Longevity, sold for US $7.6 million (¥49.4 million) in 2011; when the work reappeared at auction in 2019, the lot switched hands for only US $4 million (¥27.7 million).”