UBS Group AG, a Swiss investment bank and financial services company, has teamed up with international fair mainstay Art Basel to turn an unprecedented year into functional data in its 2021 Global Art Market Report. Featuring results from a survey of over 2,500 collectors across 10 key markets under the auspices of UBS Investor Watch and Arts Economics, it provides a wealth of insights into buyer psychology, behavior, and morale.

It’s no secret that the global economy has taken a hit across all industries, and the visual arts was no exception: while evading the fate of total shutdown, arts organizations faced enormous pressure during the moratorium on global travel, resulting in an overall sales drop of 22 percent as in-person auction opportunities dried up. Crisis breeds innovation, though, and incumbent technological shifts started to accelerate as IRL sales conventions became a thing of the past. The future is set to be hybrid: as we look forward towards a brave new world of NFTs at auction, the trickle down is set to introduce more egalitarian measures for audiences and collectors alike.

This mass move online has thwarted typical barriers for entry in the collecting sphere, piquing fresh interest from Millennials who value choice, price transparency, and convenience over the traditional modes of previous generations. Since the last big recession, private dealers have outperformed public auctions in terms of sales growth, setting the stage for another unexpected gain — private sales by auction houses rose by 36 percent from 2019.

Here are our major takeaways from the report.

Global sales of art and antiques hit $50.1 billion in 2020

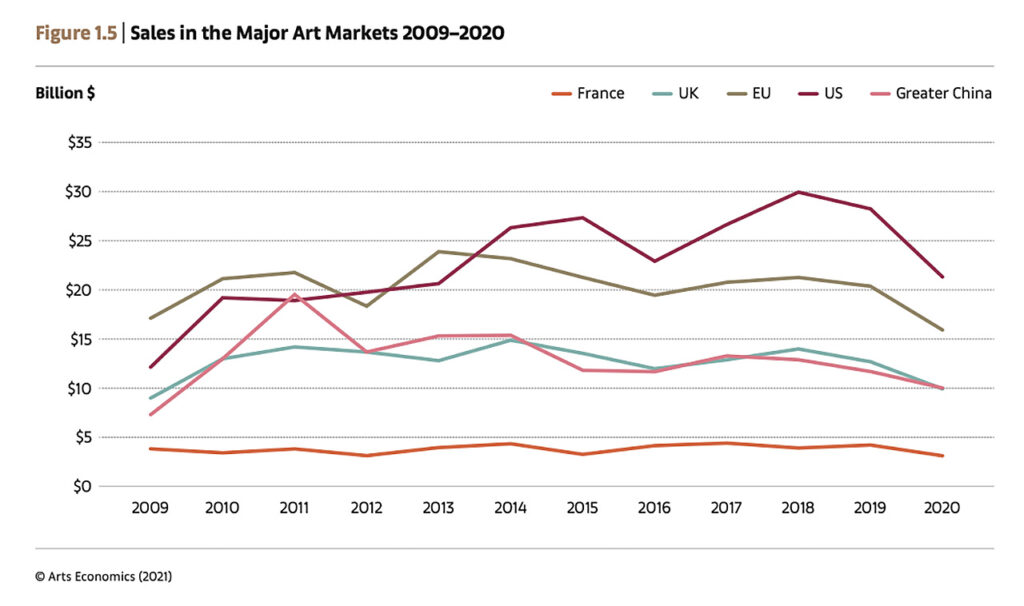

Despite experiencing a decline in sales in 2020, the major art hubs of the US, the UK, and Greater China still accounted for the bulk of the year’s global art sales at 82 percent. Image: Global Art Market Report 2021

While the figure represented a slip from its 2019 high, the final number still slotted in above the all-time 2009 recession low. The United States led with a 42 percent share of global sales values, followed by Greater China and the UK at 20 percent each. Greater China overtook the United States in the public auction market though, boasting a share of 36 percent sales by value.

Online sales skyrocketed

COVID closures encouraged a mass migration online, forcing auction houses, galleries, and fairs to follow suit. Sales online doubled in value from 2019, reaching a record high of $12.4 billion, representing a record 25 percent share of the market’s total value. This is the first time in history that the e-commerce share of the art market has exceeded that of general retail.

Collectors expressed increased interest over the course of the pandemic

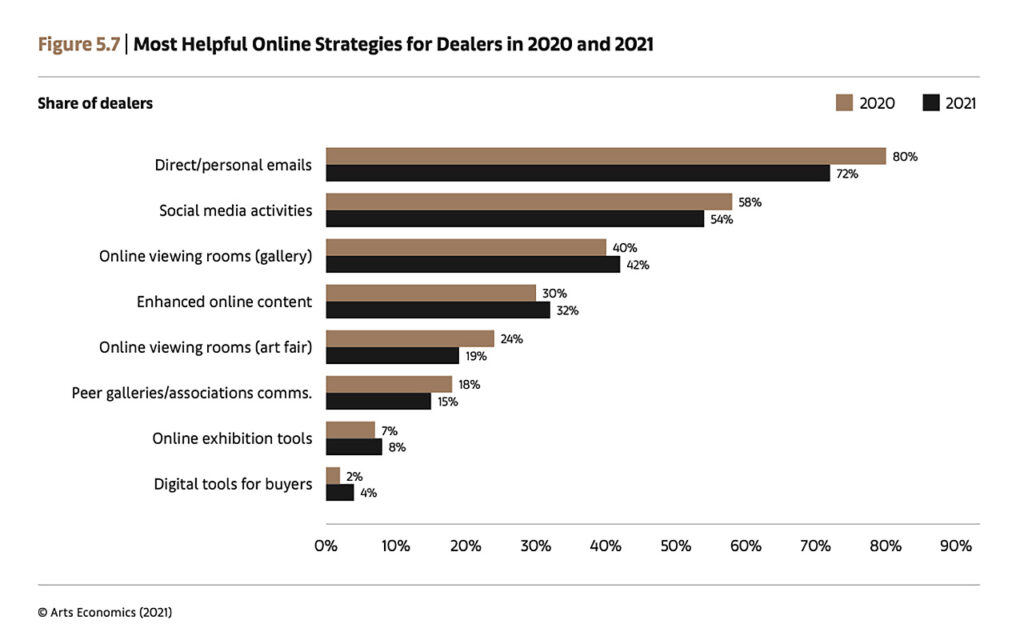

Representing a digital pivot across sectors, dealers in 2020 employed online strategies from virtual viewing rooms to social media activities to connect with buyers. Image: Global Art Market Report 2021

The collectors surveyed by the Global Art Market Report relayed surprising information about their motivations over the course of 2020. Despite being barred from in-person auctions or networking events, collectors remained actively engaged with the art market, buying 9 works a year on average, just one short of the 10 works average of 2019. 66 percent of those interviewed stated that the pandemic had actually increased their interest in buying art, and 57 percent plan to purchase more work in 2021.

Millennials are the next big collecting generation

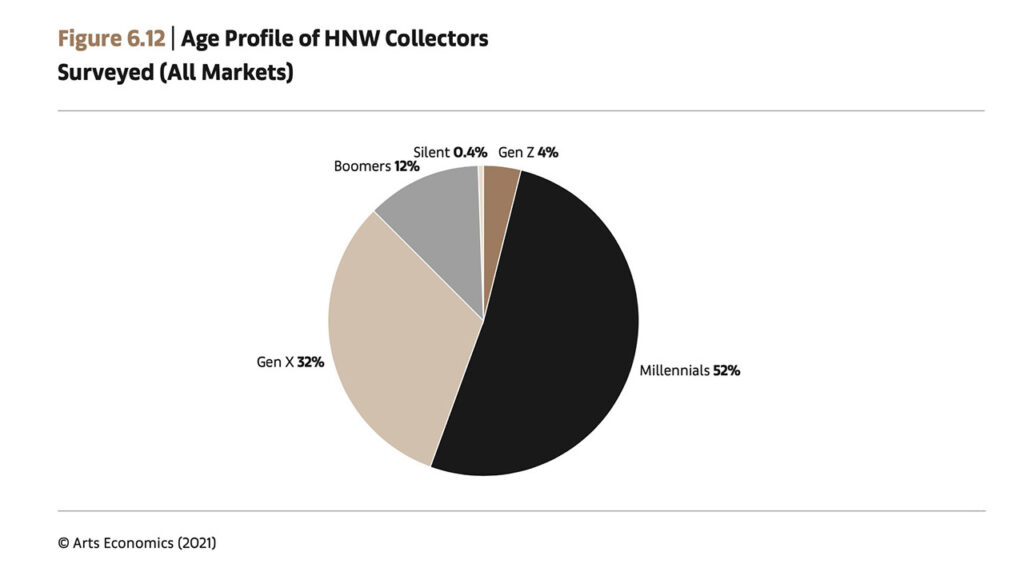

Of the Millennial collectors surveyed, 45% report having collected art for at least a decade. Image: Global Art Market Report 2021

Millennial collectors spent more on art than any other demographic in 2020, and 30 percent of them spent over $1 a pop. Tellingly, millennials were also the greatest users of social media channels and online viewing rooms.

Women are starting to gain footing

In 2021, women spent more than men on art, boasting a 13 percent rise in median expenditure to $154k. Despite glaring and continuous gender disparities in the art world, surveys indicate that shares of women’s artwork in collections is growing, increasing to 39 percent in 2020, up from 33 percent in 2018. The correlation makes sense: women are more likely to collect women than men are, and if they’re spending more money on art, the proof is in the pudding.