Consider this: Chinese mobile users spend a third of their time on video-based entertainment platforms. By 2025, China’s 1.1 billion users are forecasted to spend more than two hours a day shooting and scrolling on video apps.

Given this trend’s trajectory — one accelerated by pandemic ennui and China’s 5G rollout — it’s little wonder 2021 is being heralded as the year of mega IPOs for China’s video apps. Speculation continues to swirl around ByteDance, creator of short-video sensations Douyin and TikTok; Millennial favorite Bilibili has announced a second listing in Hong Kong; and now, Kuaishou Technologies, operator of China’s popular video app and early adopter of livestreaming, is seeking to raise $5.4 billion through an IPO set to list on February 5.

What is Kuaishou?

It’s China’s second most popular short-video app with 305 million daily active users. Kuaishou translates as “Fast Hand” and having built a reputation for platforming bizarre, curious content, it developed a strong presence in China’s smaller cities with around 60 percent residing in Tier 3 and 4 cities. Kuaishou is focused on creating connections between ordinary people — not platforming super influencers — as embodied by its motto, “Embrace All Lifestyles.”

Since launching in 2011 as a platform to make and share GIFs, Kuaishou has pioneered new modes of video engagement. In 2016, it built a wildly popular livestreaming feature and in 2018, integrated e-commerce to facilitate transactions on the platform. It’s also presented opportunities for museums hoping to connect to Chinese audiences: in February 2020, a livestream tour of the British Museum by the platform’s “Museums are Fun” channel drew more than 500,000 likes, before the Victoria & Albert Museum became the first Western museum to launch a Kuaishou account in August.

Kuaishou’s merging of its functions — i.e. e-commerce livestreaming — has shaken up China’s retail landscape. The Beijing-based company made $6.2 billion in the first nine months of 2020 primarily through the sale of virtual items (gifted by users), online marketing services, and commissions from e-commerce sales.

Kuaishou’s ecosystem encompasses livestream and short-video content, as well as e-commerce capabilities. Image: Kuaishou

Why does Kuaishou’s IPO matter?

As China’s first short short-video platform to enter the public market, Kuaishou will test investor optimism in an area that saw strong growth and attention throughout 2020.

Over the past six months, Kuaishou has driven a 254 percent increase in e-commerce sales and success will enhance its ability to continue disrupting online sales channels with its straight-shooting livestreaming e-commerce model. Kuaishou’s transformation mirrors the ever-tightening relationship between entertainment, e-commerce, and social media — thereby offering investors exposure to the particular tastes of lower-tier residents.

How will Kuaishou use the proceeds?

Kuaishou skeptics have often pointed to the company’s difficulty in generating revenue — that has changed fast. In 2017, Kuaishou drew $1.2 billion; today, it’s more than quintupled that revenue. “Kuaishou’s commercialization continues at pace,” says Michael Norris, a research and strategy Manager at AgencyChina. “We anticipate a portion of IPO proceeds [will go] to improve its on-platform advertising options.”

Kuaishou may have championed a D2C model connecting Chinese factory floors to living rooms, but another shift may be the arrival of bigger brands on the platform. “The cooperation between Kuaishou and JD.com has seen more consumer electronics and home appliances featured,” says Ashley Dudarenok, a China marketing expert, noting CEOs from prominent brands began livestreaming on the platform in mid-2020. If correct, it would likely raise the average transaction value and draw Kuaishou’s e-commerce side closer to platforms such as Taobao and Pinduoduo.

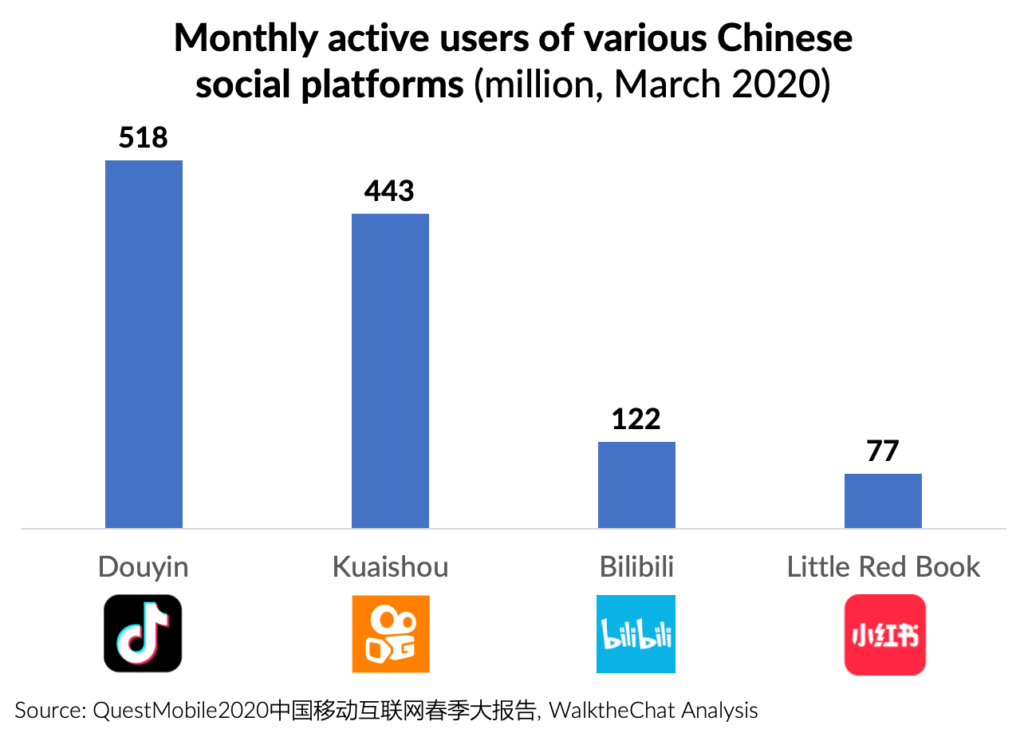

Douyin and Kuaishou’s monthly active users far outstrip that of other short-video platforms. Image: Walkthechat

What Kuaishou says

“We are a pioneer in the global short video industry… in 2012, we became the first mover in China to enable users to create, upload and view short videos on mobile devices… in 2016 we launched livestreaming as a natural extension…. in 2018, we launched e-commerce to facilitate transactions within our ecosystem…. we are actively developing additional monetization opportunities to diversify our revenue dreams through online games, online knowledge-sharing and other products and services.” — Kuaishou Technology Prospectus