Few trends are more indicative of China’s warp speed transition to digital than online payments. In under a decade, consumers and merchants alike embraced cash-free living, skipping credit cards, and turning to their smartphones instead.

Transactions require no more than a couple of taps, or a scan of a QR Code, and have thoroughly transformed Chinese commerce and daily life.

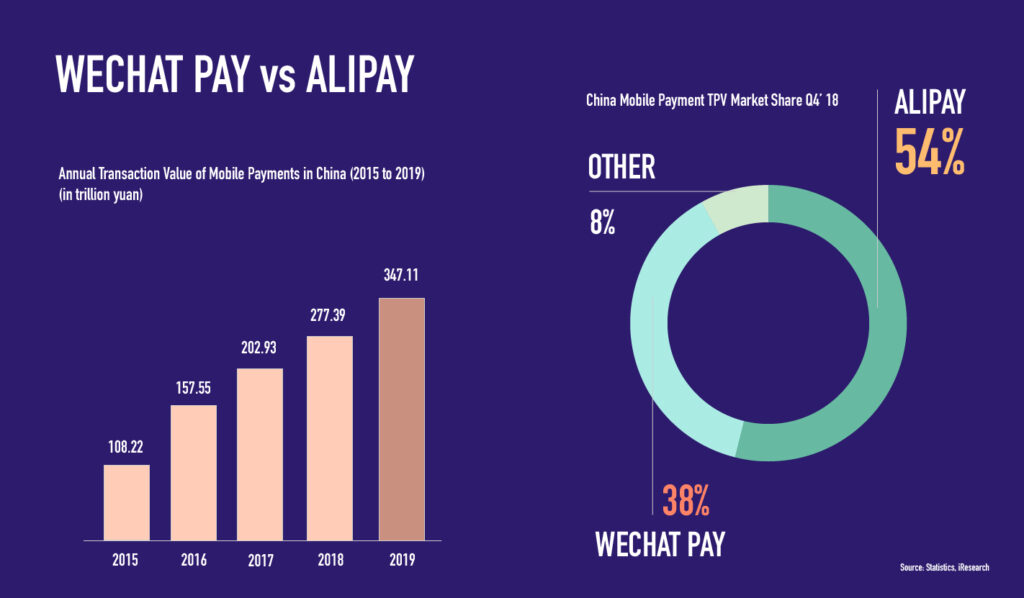

Two payment systems are primarily responsible for this revolution; WeChat Pay, an outgrowth of Tencent’s everything app, and Alipay, the platform from e-commerce giant Alibaba. They hold 38 and 54 percent of the mobile payment market respectively. Dominating the realm of card payment is UnionPay, a state-controlled company which has issued more than seven billion cards.

In 2019, WeChat Pay and Alipay accounted for more than 90 percent of China’s mobile payment TPV market.

Nearly half of Chinese mobile users own a digital wallet and the number of transactions is growing by more than 30 percent annually — data emerging from H1 2020 suggests months of COVID-19 lockdown has accelerated already ingrained digital habits. Nowhere is such proclivity for mobile-based payment systems stronger than in large Chinese cities with 92 percent citing WeChat Pay or Alipay as their primary means of payment.

Cultural Currency

Mobile payment platforms have been a gold mine for major brands and a blessing for previously disconnected mom-and-pop businesses, but China’s cultural attractions have also followed the trend by unanimously integrating mobile payment systems into their revenue strategies.

Onsite visitors can buy tickets or gift shop trinkets via QR Codes and netizens can browse e-commerce stores or purchase e-tickets through social media platforms — a boon when it came to reopening under timed-ticketing restrictions in the wake of COVID-19.

Chinese are increasingly keen on replicating their mobile-centric shopping habits while traveling internationally, both for the convenience of not carrying cash and avoiding unfavorable fees and currency conversion rates. And with the aggressive maneuvers of Alibaba and Tencent they’re being accommodated. WeChat Pay is now accepted at merchants in more than 40 countries and Alibaba is trying to corner the outbound tourism market by striking partnership agreements with international payment companies.

But, beyond goodwill, what’s the benefit of integrating such platforms for cultural attractions? Simply put, 91 percent of Chinese tourists say they are willing to spend more when merchants accept mobile payments.

Next week, we will look deeper at WeChat Pay, Alipay, and UnionPay and offer examples of international cultural institutions that have successfully integrated China’s digital payment platforms.

Words by Richard Whiddington