Subscription video platform iQIYI’s market capitalization stood at nearly $20 billion in 2021. Since then, the value of the Chinese video-streaming giant has plummeted 73.5 percent to just $5.3 billion.

Similarly, previous investor darling and short video-streaming platform Bilibili saw its value drop from $54 billion to $6.5 billion in the same time frame.

Compare this to Douyin, which was named the world’s most valuable unicorn in H1 2022 with a $200 billion valuation. What happened to China’s former streaming powerhouses?

Losing luster

Bilibili was once praised for its unique business model and popularity among China’s youth, particularly those with an interest in anime, comics, and games.

As China’s closest counterpart to Youtube (which is currently censored in the nation), Bilibili has over 600,000 active content creators across its platform. The app focuses heavily on community as opposed to “professional content” platforms like iQIYI, which are better known for their variety shows, movies and more.

Bilibili is similar to YouTube in its focus on user-generated content. Image: Bilibili

The platforms are still behemoths though. Bilibili ranks third by global traffic share in the Arts & Entertainment category, just after YouTube and Netflix. iQIYI, founded by Baidu in 2010, is not as well known as its fellow streamers but has nearly 130 million paid subscribers. In comparison, Netflix stands at 238 million paid subscribers and Disney+ at 157 million. So what led to the downturn?

Complicated quandary

One of a myriad of problems hitting platforms over the last couple of years is investor sentiment towards Chinese platforms. Even China’s profitable tech titans like Tencent and Alibaba aren’t performing well on the market. Since the beginning of the pandemic, the market value of China’s largest tech corporations has diminished by $300 billion, while their American competitors have seen an increase of $5 trillion.

Another issue is decreased ad revenue due to the Covid-19-triggered economic slowdown. iQIYI’s ad revenue in the fourth quarter of 2022 decreased 7 percent to $225 million, out of total revenues of $1.1 billion. Bilibili’s business model is less affected by ads, as the platform is strongly gaming- and subscription-based, with 28 million paid users.

Bilibili boasts 326 million monthly active users, with 70 percent between the ages of 18 and 34. It’s increasingly looking to e-commerce for growth, and as a key platform for user-generated content, it’s still a force to be reckoned with.

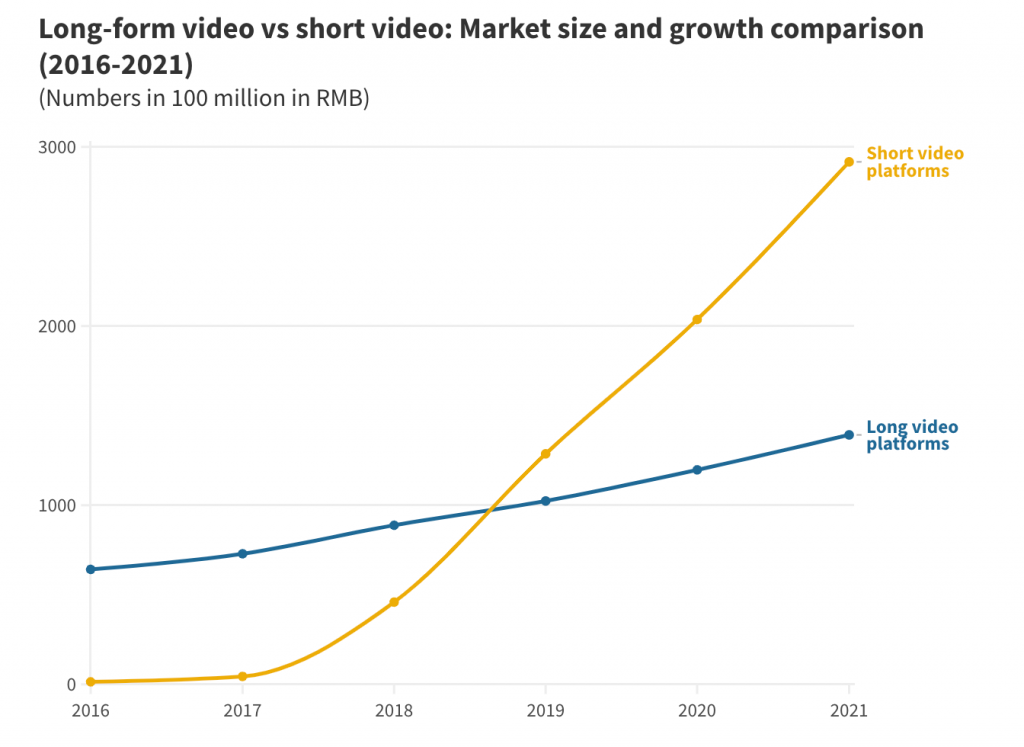

Short video platforms overtook long video platforms in market size in 2018. Image: Qianzhan and MobTech

None of this means Bilibili is out of danger, however. In fact, the strongest threat to its survival lies in the rise of short-video platforms.

Short video platforms overtook long video platforms in market size back in 2018. Examples from the West highlight how TikTok’s astronomical growth spurred YouTube to answer with Shorts and Instagram with Reels.

Bilibili attempted to rival its main competitor Douyin in 2018, with the launch of Light Video. Light video boasted Bilibili’s famous “bullet comments” feature, in which live lines of user’s comments flashed across the screen. Ultimately, the app didn’t take off and was shuttered last year, as Bilibili rolled out a vertical video feature similar to Stories on its main app, making Light Video redundant.

Baidu-backed iQIYI just posted its first annual profit since the company’s inception, mostly thanks to new subscriber growth and aggressive cost-cutting as profits became positive despite a 5 percent fall in revenue compared to the previous year. iQIYI has long looked overseas for expansion, even advertising in New York’s Times Square back in 2018. In April of this year, iQIYI announced it’d be expanding its reach further to Spanish-speaking countries such as Spain and Mexico.

Bolstered by dreams of the metaverse, iQIYI has also looked to VR for growth. In 2021, the streamer launched its flagship VR headset and even unveiled an immersive VR ride based on one of its self-developed shows. Yet in August of this year, the VR division was plagued by bad news as it became clear that the business had failed to pay its employees due to an inability to meet predefined sales targets.

For both Bilibili and iQIYI, it seems like there’s still a bumpy road ahead.