Fuelarts, an accelerator specializing in the art and technology industry, has released its latest report, Art+Tech & NFT Startups Report, which logs investments in the art, tech, and NFT sectors in the first half of 2022. To compile the report, Fuelarts primarily relied on public data recorded on Crunchbase and PitchBook, as well as a global survey of company and market representatives, including strategists and analysts.

Chiefly, the report found that while startup investments dipped in 2022 due to the downturn in cryptocurrencies, the industry remains in the billions of dollars. H1 2022 saw 111 digital and NFT startups receiving some $2.5 billion of funding, while most strategists surveyed by Fuelarts remained optimistic that NFT prices will bounce back.

Fuelarts found that investments in NFT and art+tech startups dipped in the first half of 2022, correlating with a dip in the cryptocurrency market cap. Image: Fuelarts Art+Tech & NFT Startups Report H1 2022

For Denis Belkevich, Founder and General Partner of Fuelarts, such data is key, not just to help new investors make decisions, but to track markets such as digital and NFTs that are emerging and lack history for now. “Fuelarts focuses on four key questions in order to provide that data,” he tells Jing Culture & Crypto. “What is the number of the startups that are behind the ecosystem? Has the asset been created before trading? Does anyone care about the market? Is anyone tracking the market?”

According to him, Fuelarts is planning to increase its reports to four a year, and to delve into more specific areas like gamification and marketplace analytics. For now, here are three noteworthy takeaways from this year’s report.

Investments in physical vs digital startups

The bulk of investments in NFT companies went toward startups focused on content production, including R&D. Image: Fuelarts Art+Tech & NFT Startups Report H1 2022

In the first half of 2022, 123 art+tech startups received $2.6 billion in total funding, compared to 12 startups in the physical art market, which collectively received $99.2 million. The finding, in Belkevich’s view, makes sense: “Physical art startups are more sustainable; their business models have been checked. Investments in 12 brick-and-mortar markets is still a good sign because it means that those startups have already found their market fit and that there’s continued market interest.”

Meanwhile, in the Web3 sector, the bulk of investments went toward startups centered on production (including R&D and gamification), followed by game-fi and trade companies. This is in stark contrast to data from 2021, when trade-related startups (including marketplaces, wallets, exchanges) received the most amount of funding.

Interestingly, traditional and non-crypto VC investors and individuals were the most active in funding art+tech and NFT startups, making up 33.6 percent and 22.5 percent of investments respectively. Investors, it seems, are testing the waters rather than diving in, as the majority of investors (86.6 percent) made only one investment into infrastructure startups.

The regional split

In Asia, Singapore led with the most startups that received funding in H1 2022, though of the two Hong Kong startups on the list, Animoca Brands, the platform behind The Sandbox, held the near majority of funding. Image: Fuelarts Art+Tech & NFT Startups Report H1 2022

Much like the traditional art world, startup funding in H1 2022 bore out regional concentrations. The US recorded the highest number of art+tech and NFT startups receiving investments, followed by Singapore and the UK. In particular, 18 startups in the Asia and Oceania region saw funding that topped out at $35 million, representing a quarter of all global investment.

“We really have three centers in the art world: New York, London, and Hong Kong,” reflects Belkevich. “The startup world is geographically similar, but US investors are investing only in those companies who have US incorporation, so a lot of founders from Asia may have to go to the US to receive investments. Additionally, a lot of Chinese artists are represented in Australia by Australian galleries, and vice versa — so this encourages a geographical spreading and migration.”

US-based Yuga Labs (home to Bored Ape Yacht Club) topped the chart with the most investments in H1 2022 with $450 million. Startups focused on content production, as mentioned above, had much greater investment margins, indicating that there’s significant interest in the market’s continued growth, which requires fresh ideas and assets.

The role of curatorship in tomorrow’s NFT art market

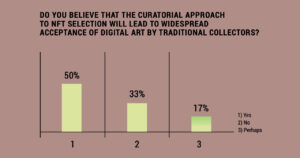

Half of survey respondents saw the potential for curatorship to drive acceptance of digital art, with 17 percent still on the fence. Image: Fuelarts Art+Tech & NFT Startups Report H1 2022

Even though the report found that there was much less investment into physical art markets, 83 percent of survey respondents believed it is inevitable that the market will turn towards physical art again. While physical art does have “tangibility” and a mature market on its side, Belkevich warns of underestimating digital art commerce, a sector that is illustrating a “generational shift.”

For the space to evolve and develop, he highlights the role of curators. “Curators add artistic and monetary value, and knowledge by virtue of their evaluations of the digital art market, given their knowledge of the historical art market,” he says. “In other words, they are the link between the non-digital art worlds and the digital art world.”

Survey respondents likewise saw the need for curatorship in the digital art sector: the majority (67 percent) felt that a curatorial approach will or might help in the promotion and acceptance of NFTs by traditional collectors. Similarly, half of respondents believed the biggest obstacle to widespread adoption of NFTs is the lack of a specialized share exchange, like an Art NASDAQ. One would imagine that curatorship, which is a form of centralizing knowledge, could help inform such an exchange.

“There is a very, very tricky balance between decentralization and anarchy,” Belkevich adds. “Curators help us balance this. In this context, the curator is not an institutionally appointed person. It is the person whose choice and taste has been chosen and approved by the community, by an internet audience.”