MINISO, China’s low-cost variety store, is in a global expansion frenzy. Over the past 12 months, the retailer (think Muji for teens at knockdown prices) has opened a store a day from Lanzhou to Lille, France. And it’s paying off. After losing money in the early months of the pandemic, MINISO now operates in 94 markets beyond China and with revenue up nearly 40 percent, the impulse-buy merchant is enjoying its best quarter since 2019.

Toy sales, which grew 189 percent year-on-year in 2020, have been key to this success and now underpins MINISO’s latest venture: TOPTOY, a chain striving to become the market leader for specialty collectible toys.

What is TOPTOY?

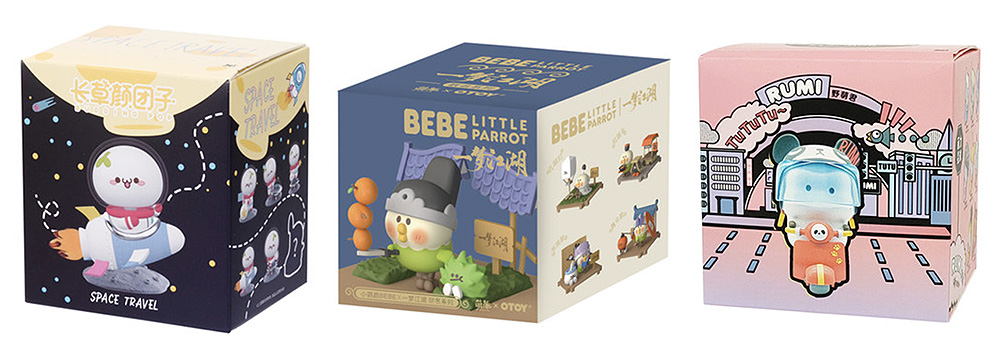

MINISO’s vast range of TOPTOY offerings spans its own IP creations, and those by brands such as Marvel and Disney. Image: TOPTOY on Tmall

Launched as a sub-brand by MINISO in December 2020, TOPTOY sells collectible art toys aimed at post-’80s and post-’90s consumers. It currently sells more than 2,000 products, a mixture of its own IP products and those by external brands such as Marvel and Disney, at price points far higher than toys sold at MINISO (which range from $10 to several hundred dollars). It hopes to begin opening international stores later this year.

What are collectible art toys?

Vinyl figurines (three inches to two feet in size) created by designers and brands often around IP characters. Popular toys are iterated adopting a variety of guises and poses, and released in limited-edition batches, therein creating scarcity and collectability. Pop Mart has pioneered the collectible art toy space and the practice of blind box-selling, packaging obscuring the identity of a toy, and currently holds 8.5 percent of a market valued at $3.1 billion in 2019.

Why did MINISO launch TOPTOY?

TOPTOY’s blind boxes tap young consumers’ appetite for collectible art toys and the trend of unboxing. Image: TOPTOY on Tmall

Because there is huge demand among young urban consumers for collectible art toys, as MINISO has experienced in-store over the past year. Post-’80s and post-’90s consumers enjoy the ritual of buying and opening collectibles as part of a leisure lifestyle (videos depicting eager blind box-openers is a whole subcategory on social channels), and gain social currency through collecting. Data shows China’s top five art toy companies accounted for less than a quarter of a market leaving ample room for an ambitious newcomer.

Will TOPTOY succeed?

It’s a smart maneuver. First, there’s considerable overlay between consumers who have grown up with MINISO in their local shopping mall and those collecting art toys, which grants TOPTOY immediate brand recognition. Second, there’s space in the market for an aggressive Pop Mart competitor and MINISO has a wealth of experience in creating attractive physical shopping environments that appeal to young consumers — a point Pop Mart’s founder, Wang Ning, sees as the best form of advertising to draw new customers.

Success, however, will likely hinge on TOPTOY’s ability to develop its own in-demand IP characters. “TOPTOY wants to integrate IPs and products from different brands into one store,” says Ye Chen, a research analyst at ChemLinked, noting the in-store presence of toys from Marvel, Lego, and King of Glory, “but TOPTOY knows it’s risky to only sell others’ products and they want to develop their own IPs.” Chen estimates a 70/30 split between external and self-owned IPs. Designing and developing IPs to fill that 30 percent will be the key.

What TOPTOY said

“The toy category became another new growth engine for MINISO. In response to the strong market demand, MINISO launched its first independent sub-brand called TOPTOY to serve the higher-end collectibles and art toy markets. TOPTOY is angling to become a leader in China’s booming toy market” — Miniso Group