A Thai vacation conjures a broad spectrum of inviting images, from cliff-sheltered bays with silky white sand to sprawling fluorescent night markets, hedonistic raves, and some of the world’s most luxury hotel experiences. Thailand’s great tourist boom over the past two decades can, in part, be explained through its success in promoting radically different getaways.

Now, as Thailand emerges from its astute handling of the COVID-19 pandemic — and looks towards opening up to the world — it must focus on presenting itself as a destination that prioritizes the safety of its visitors, and in the process, regaining the trust of its most lucrative market, China.

For Aleenta Phuket-Phang Nga Resort & Spa, a luxury five-star beach resort in Phang Nga, Phuket, this means applying hospital-level sanitation to its beach-front villas, dining rooms, and infinity pools. For years, Aleenta has advertised its Mandarin-speaking staff and China-tailored menu options as selling points on Chinese travel websites. Today, it presents a hygiene certificate demonstrating compliance with the Civil Aviation Association of China (CAAC) standards.

“You have to bite the bullet and hope that the drastic action will sort this out,” said Aleenta’s parent organization, AKARYN Hotel Group, via email. “Hygiene is now the top priority, social distance is great for Aleenta Resort, our rooms are mostly villas and each unit is very large with lots of space.”

In recent weeks, Thailand’s domestic tourism market has been offering travel service providers an invaluable opportunity to fine tune hygiene and social distancing practices in anticipation reopening to inbound travelers. But beyond local proactivity, the return of Chinese travelers, once projected to top 11 million in 2020, will depend largely on three factors — government facilitation, airlift, and consumer willingness.

Government Support

Thailand has a strong track record of mobilizing and adapting to Chinese outbound tourism. Backed by the Thai government’s visa-on-arrival policy, Chinese tourist numbers grew from 1.2 million in 2010 to 10.9 million in 2019, a year in which it began trialing waiving visa fees. This has been seen, by some, as an attempt to restore the reputational damage dealt by the 2018 Phuket boat disaster in which 47 Chinese nationals were killed.

Thailand may have closed to Chinese tourists on March 7 due to the pandemic, but the Tourism Authority of Thailand (TAT), which has five regional offices in China, has used its strong digital presence to express support and provide vital travel information throughout the crisis. At a moment of geopolitical tension between China and a host of other nations, the goodwill projected by Thailand’s official tourism arm — and the absence of government finger pointing — will remove one diplomatic barrier as the country hopes to reopen to Chinese travelers.

Airlift

Affordable flights have been the backbone of Chinese tourism to Thailand. Beginning in 2012, budget airlines launched flights from more than a dozen Chinese cities and over the following six years seat capacity would increase fivefold. However, incoming commercial flights remain banned until May 31, after which point establishing a travel-bubble with China, as Vietnam is tentatively considering, will be essential.

Restoring air services to gateway markets such as Bangkok, capable of offering a high-level of control over screening, is likely to take place first, which will facilitate business travel then independent and small group travel. “Airlift is everything,” says Bill Barnett of C9 Hotelworks, a hospitality consultancy focused on Asia-Pacific. “You can’t stay there if you can’t get there.”

Chinese Consumer Sentiment

Although Chinese travelers are prioritizing short, domestic trips over the coming months, Thailand’s competent handling of the pandemic — 56 deaths at the time of writing — and relatively proximity to China place it among the most desirable outbound destinations.

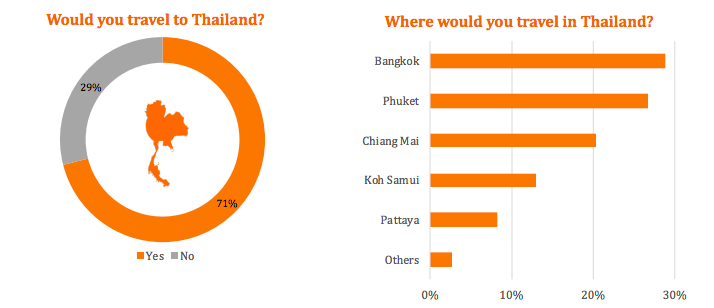

A survey from mid-April focused on potential Chinese travelers to Thailand from Tier-1 cities showed 53% looking to travel abroad in 2020, with 71% considering Thailand. “Chinese people feel short-distance [travel] is safer and more flexible,” says Ashley Dudarenok, founder of China marketing agency Alarice, noting that the affordability of a Thai holiday will further the appeal.

“The best way to address this market is digitally and understand the cultural and language nuances,” says Bill Barnett, Managing Director of C9 Hotelworks.

The impact of currency fluctuations on Chinese tourism numbers is often underestimated and if there is a silver lining for a shattered industry that typically contributes 10% of Thailand’s gross domestic product, it’s the strength of the Yuan relative to the Thai Baht. “Currency is always an issue and the stronger Yuan will increase spending power” says Barnett. “The current outlook of a strong currency bodes well for travel.”

Restoring Paradise

Blessed with short and affordable flights from China, Thailand holds enviable geographic advantages, but the country’s competent handling of the pandemic will prove a more important factor in luring tourists back. Over the coming months, the global travel industry should watch the actions of Thai tourism stakeholders closely as they pitch the Chinese traveler with a new type of vacation. The reality of Chinese “revenge travel” remains to be seen, but any resurgence will undoubtedly be built on guaranteeing traveler health and safety.