In 2021, the United States continued to lead the pack in art trade. Still the world’s largest art hub, the nation accounted for 43 percent of global sales by value, fueled by its substantial collector base, looser trade regulations, and healthy cultural infrastructure. In particular, the latter, made up of for-profit auction houses and galleries as much as non-profit institutions, has played a crucial role in supporting art trade, whether by platforming artists, developing markets, or otherwise sustaining collecting culture.

And it’s this ecosystem that forms the focus of UBS’ latest report, compiled in partnership with Arts Economics with data from Wondeur AI. The Role of Cities in the US Art Ecosystem offers a granular view of cultural programming across major US art centers from New York to Chicago. This data is further intended to drive insights into how cultural organizations in these metropolitan cities, in their choice of who and what they exhibit, have variously generated value and biases in the sector. Here are three headline findings.

Which city is cornering the cultural market?

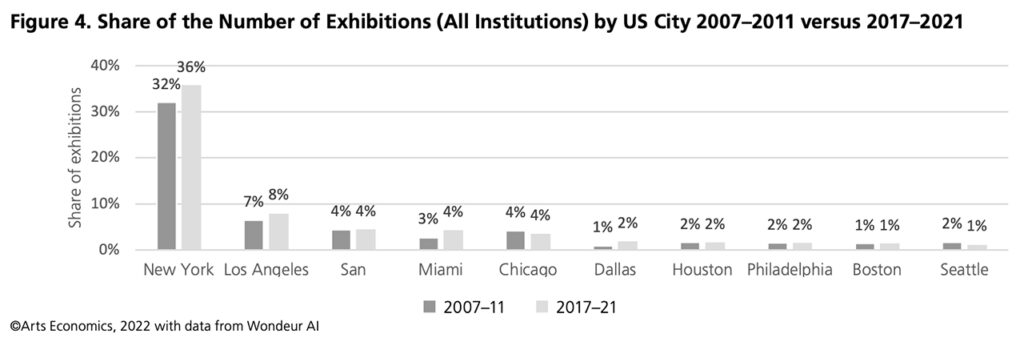

New York remains a cultural force, hosting more than 30 percent of all exhibitions in the US since 2007. Image: © Art Economics, with data from Wondeur AI

Unsurprisingly for a city with the highest concentration of cultural institutions and galleries, New York remains the heart of the country’s art ecosystem. Last year, the city hosted 36 percent of the exhibitions in the US, compared to Los Angeles’ eight percent and San Francisco’s four percent — a stunning margin that also ranks it, according to surveyed collectors, as the top city in which to view art. Additionally, as the report points out, New York further happens to house a considerable population of millionaires and billionaires, who, in a virtuous cycle, help support art trade and hence, the city’s array of commercial galleries.

Who’s going on exhibition and on sale?

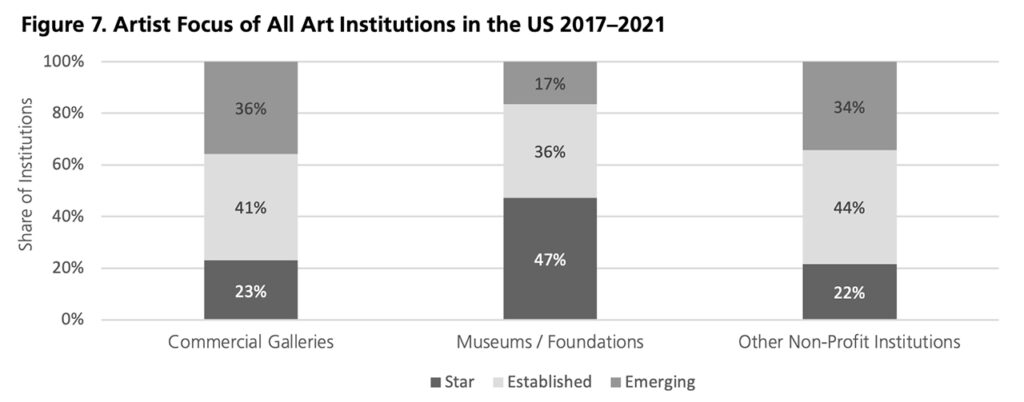

By the study’s measure, Star and Established artists dominate museum and gallery programs, though galleries were more willing to lean into Emerging artists. Image: © Arts Economics, with data from Wondeur AI

The UBS study further assessed the programming focus of for-profit and nonprofit venues, categorized in three broad categories, Star, Established, and Emerging artists. Here, the contrast between the museum and gallery sector stood out starkly: while institutions were more prone to focus on Star artists, who made up 47 percent of their exhibitions from 2017 to 2021, commercial galleries leaned into Emerging artists, who accounted for 36 percent of their programs. In fact, across five major metropolitan US cities, Star and Established artists dominated museum programming, with Emerging artists getting the most (however minor) exposure in Chicago (24 percent) and Los Angeles (21 percent).

Likewise, female artists continue to lack representation whether in museums or galleries. Across the board, works by women made up less than half of sales and exhibitions. Where female artists are significantly featured though: as Emerging artists in museums in Los Angeles (57 percent) and Chicago (52 percent).

Why the disparity?

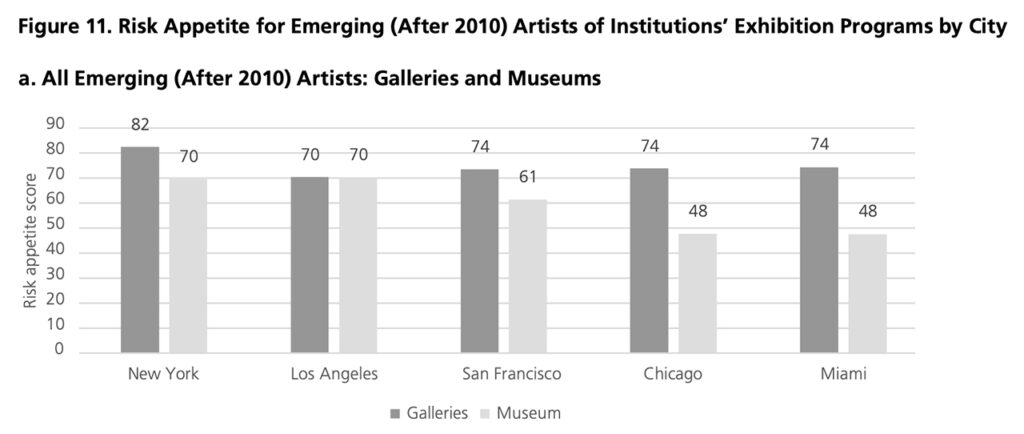

Across the board, galleries displayed a higher risk appetite than museums, with New York housing the biggest risk-takers. Image: © Arts Economics, with data from Wondeur AI

In short: risk tolerance. Using metrics by Wondeur AI, the report scored the risk appetite of institutions on a scale of 0 to 100, with a higher score indicating a higher risk tolerance or willingness to program new or Emerging artists ahead of other venues. Overall, in the period between 2011 and 2021, New York’s cultural practitioners evidenced the highest risk appetites. On a more micro level, the museum and gallery sectors diverge in risk tolerance, with the former, as expected, demonstrating less tolerance and a more conservative approach toward showing Emerging or Emerging female artists. New York and Los Angeles museums, though, were the most willing to take risks, with Chicago institutions representing the least.

And do these risks pay off? For the artists featured, yes, according to Wondeur AI’s performance metric, a 0 to 40 score calculated by measuring the growth in an artist’s cultural recognition. Even segments with the lowest risk appetites, like galleries in Los Angeles (72) and museums in Chicago (48), saw highly ranked performances (30 in Los Angeles; 34 in Chicago), reflecting how an exhibition, particularly in a museum, could accelerate an Emerging artist’s career.