The intertwining of art and blockchain technology has been underway for years. But with a pandemic fallout that has dramatically impacted institutions and decimated artists’ income, that relationship has grown and thrived in 2020 — providing digital artists a much-needed avenue to present and sell their creations, and collectors an innovative way to discover art. As our world grows increasingly virtual, this surge of the crypto art market should come as no surprise.

“This year, we’ve seen a lot more folks from the more traditional world start to get involved,” says John Crain, the CEO of SuperRare, a marketplace for single-edition digital works, which he co-founded in 2017. “It is probably a byproduct of the pandemic. People started to take digital more seriously.” Sales on the platform jumped from $1 million total sales at the beginning of 2020 to more than $5 million towards the year’s end, he adds.

SuperRare, along with other crypto marketplaces like OpenSea, MakersPlace, and KnownOrigin, sell art in primary and secondary transactions and function on blockchain networks — shared, decentralized cryptographic ledgers that track assets. Works, purchased in cryptocurrency like Ether (on the Ethereum blockchain), are sold as Non-Fungible Tokens (NFTs), unique digital tokens tied to blockchains that represent an asset, guaranteeing its value and scarcity.

“Once artists start to learn more about cryptocurrencies, they’re excited to accept them and often prefer them to dollar payments,” Crain says. Cryptocurrency has weathered 2020 well: Ether, on the Ethereum blockchain, began the year at $130.27 and is now worth $627.69, while Bitcoin hit an all-time high in December — the equivalent of $23,527.10 in U.S. dollars.

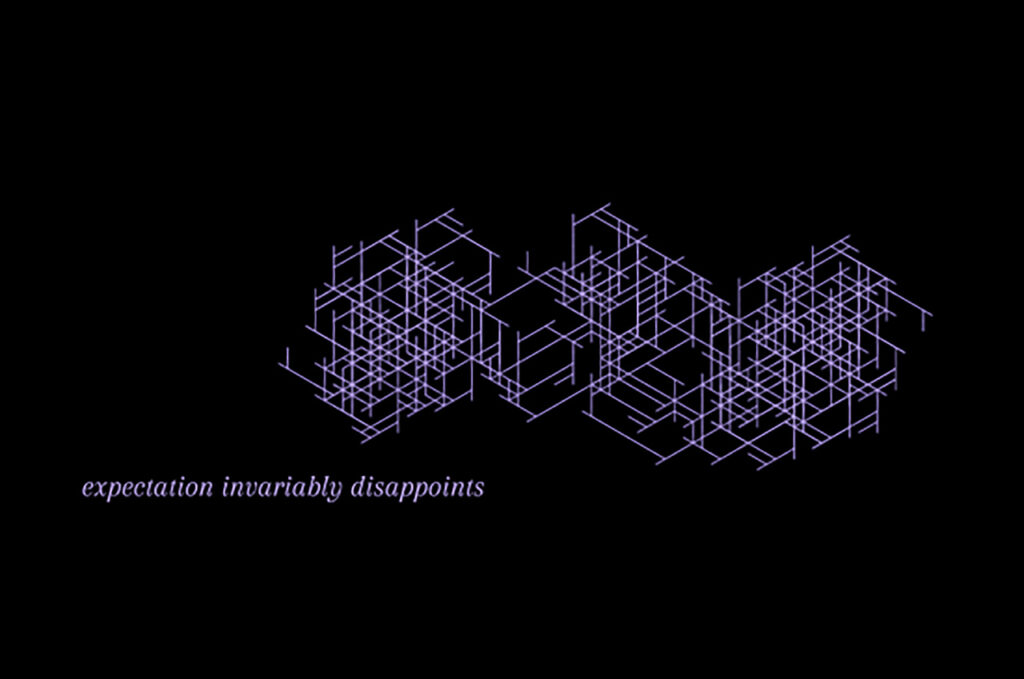

Some of the artists who sell on SuperRare also have separate gallery representation, though due to in-person shows drying up, they “were able to heavily supplement or switch over their income to purely digital,” notes Crain. In December, the pseudonymous Pak became the first crypto creator to pocket more than $1 million (or 1,881 in Ethereum tokens) from blockchain-based works.

Meanwhile, institutions have been entering the blockchain ecosystem too. After the Austrian Museum of Applied Arts became the first museum to fork over Bitcoin for an artwork in 2015, other cultural institutions from Cleveland’s Great Lakes Science Center to Florida’s St. Petersburg Museum of History have experimented with Bitcoin payments to enhance visitor experience.

Dutch artist Harm van den Dorpel’s limited-edition screensaver, Event Listeners, was the first work of art to be purchased by a museum using Bitcoin. Image: Cointemporary

In Switzerland, Kate Vass Galerie has been working in both the physical and digital realms. Besides moving physical works in both in Fiat money and cryptocurrency at its Zurich space, it’s been selling digital pieces as NFTs on blockchain marketplaces like SuperRare and MakersPlace since 2019. According to the gallery, in the past year, “we’ve been witnessing a remarkable growth of active collectors and bids, which led to a rise in the prices.” Ten crypto works created by the Nigerian artist Osinachi for a solo show in early 2020 sold out on SuperRare and tripled in value within two months.

And artists see the benefits of this appreciation on crypto platforms with built-in resale royalties. “One of the huge advantages of NFTs is you get to track the value of the piece over time,” said the New York-based artist Pearlyn Lii, who sells short video works from her ongoing project Real Girlfriend (2020) on Foundation. The platform provides a 10 percent royalty each time fractions of works are resold, as do Ephimera, KnownOrigin, MakersPlace, and SuperRare. It’s a cut that “artists and collectors together, chatting online,” says Crain, collectively negotiated for.

Already, crypto has massively democratized the making and selling of works by cutting out the perennial middle men, with further implications that will bear out in the licensing, publishing, and distribution of art. The crypto art space is now crowded with not just artists and investors, but decentralized blockchain-based museums such as Wunder and Museums Chain, crypto art events like BitBasel, and blockchain–focused exhibitions. It remains to be seen how sizable a dent blockchain technology will make on the art market, but having galvanized the sector’s digital transformation, it’s likely to be a vital fixture in art and museum futures.